Turnover Definition For Gstr 9 Learn how to correctly file Form GSTR 9 covering all six parts and 19 tables Understand basic details supplies ITC tax payments and more

Annual Aggregate Turnover AATO is crucial under GST it defines threshold for registration and composition scheme Computed at PAN level it includes various components GSTR 9 is the annual return form summarizing all transactions for the year while GSTR 9C is a reconciliation statement for businesses with an annual turnover exceeding a

Turnover Definition For Gstr 9

Turnover Definition For Gstr 9

https://www.forbes.com/advisor/wp-content/uploads/2022/09/Image_-_Employee_Turnover_Rate_.jpeg.jpg

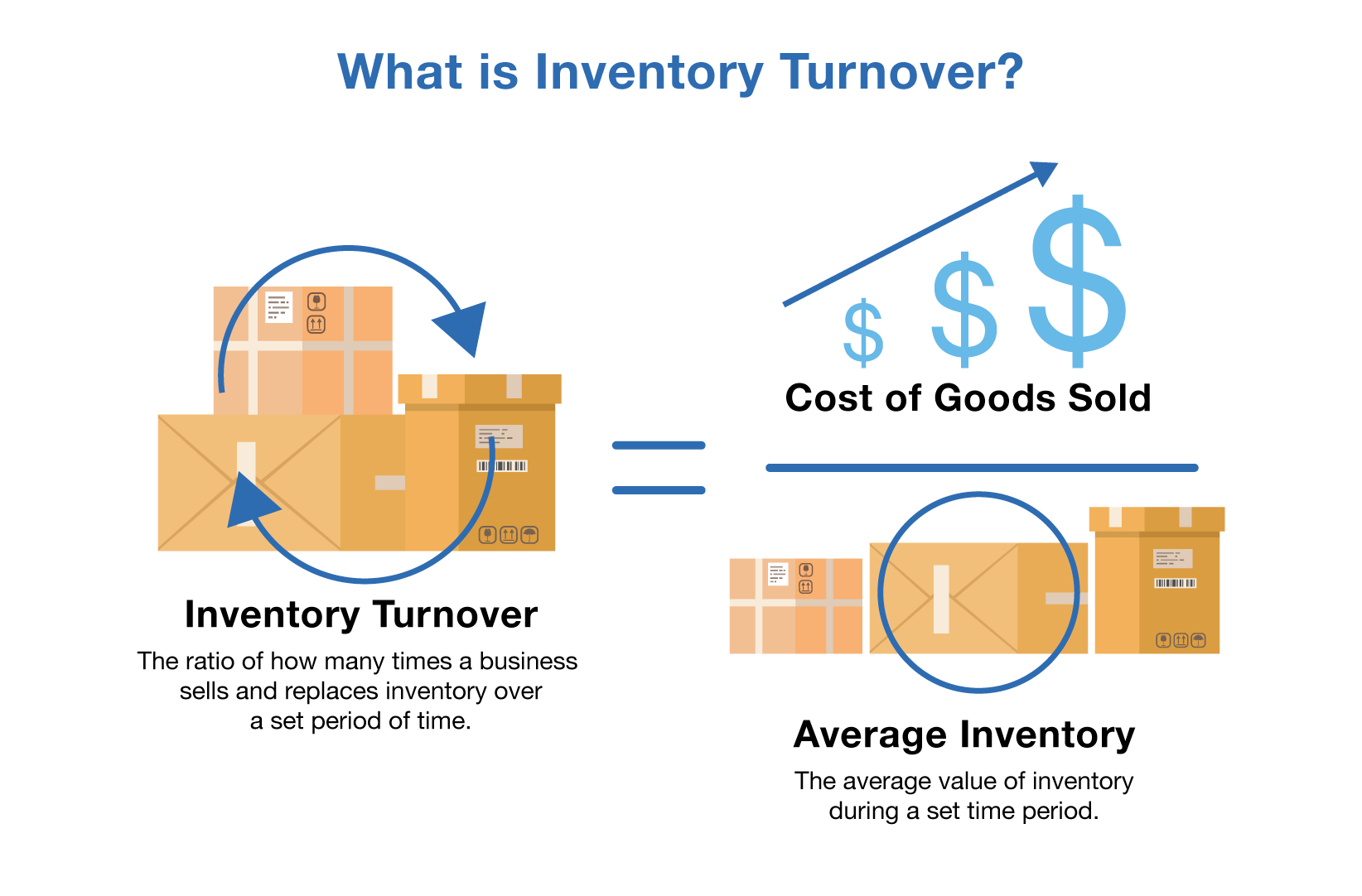

Inventory Turnover Ratio Formula Importance Example

https://admin.mybillbook.in/blog/wp-content/uploads/2022/06/inventory-turnover-ratio.jpg

Turnover Creative Cooks

https://creative-cooks.com/wp-content/uploads/2014/03/turnover.jpg

The registered persons having an aggregate turnover upto Rs 2 crore from filing the annual return Considering the significance of filing of annual return in GST compliances the GST What is GSTR 9 annual return under GST GST Annual Return is to be filed by the registered taxpayer whose turnover for the year exceeds Rs 2 crores GSTR 9 is basically a

GSTR 9C The tax payers whose annual turnover exceeds Rs 2 Crores are required to file the annual return in form GSTR 9C All the tax payers who are required to get their books of accounts audited should also file a Form GSTR 9C is required to be filed by every registered person whose aggregate turnover is above a certain threshold during the financial year as notified by way of Notifications issued

More picture related to Turnover Definition For Gstr 9

How To Calculate Trading Turnover Binomo Help Center

https://binomo2.zendesk.com/hc/article_attachments/4410378027923/calc_turnover.png

Turnover Meaning YouTube

https://i.ytimg.com/vi/WeWgsSfbKoA/maxresdefault.jpg

Turnover United Control Engineers India Pvt Ltd

https://unitedcontrolengg.com/wp-content/uploads/2023/04/Turnover-Video.gif

If a person has taken registration under GST in more than one state and aggregate turnover exceeds Rs 2 crores during any financial year then he she is required to file an annual return The CBIC has exempted GST registered taxpayers with annual aggregate turnover up to Rs 2 crore in FY 21 22 from filing Form GSTR 9 GSTR 9C is a reconciliation

Both of the requirements are depending upon the quantum of aggregate turnover for FY 2020 21 Further GSTR 9C requires the reconciliation between turnover as per audited The Form GSTR 9C is to now be self certified and submitted by taxpayers with a turnover of more than Rs 5 crore from FY 2020 21 onwards To read more about this change

Turnover By THEOFFICIALRAM

https://content.beatstars.com/users/prod/142654/image/CzCCw3StPZQg/exampled2.png

How To Check Turnover Sales In GST Portal Online Turnover Limit For

https://i.ytimg.com/vi/PHJwh56ZmzA/maxresdefault.jpg

https://taxguru.in › goods-and-service-tax

Learn how to correctly file Form GSTR 9 covering all six parts and 19 tables Understand basic details supplies ITC tax payments and more

https://cleartax.in › aggregate-turnover-under-gst-for-registration

Annual Aggregate Turnover AATO is crucial under GST it defines threshold for registration and composition scheme Computed at PAN level it includes various components

Turnover L G 6 Nguy n Nh n D n n T nh Tr ng Staff Turnover

Turnover By THEOFFICIALRAM

Inventory Turnover Ratio Definition Formula

R duire Turnover En Augmentant L engagement Des Salari s

What Is Employee Turnover Archives NIA Blog

Improving The Turnover Ratio A Key

Improving The Turnover Ratio A Key

Request A Demo Of Turnover Reporting

What Is The Turnover How To Calculate The Turnover InfoComm

Average Employee Turnover Rate By Industry Role Flamingo

Turnover Definition For Gstr 9 - GSTR 9C The tax payers whose annual turnover exceeds Rs 2 Crores are required to file the annual return in form GSTR 9C All the tax payers who are required to get their books of accounts audited should also file a