Turnover Definition As Per Income Tax Act Learn how to calculate gross receipts and sales turnover for tax audits with our detailed FAQ guide Understand inclusions exclusions and specific scenarios for accurate tax

Sec 145A is for determination of only income chargeable to tax but not for determination of tax rate thresholds etc However in the absence of any other definition of turnover gross receipts provided in the Act it leads Section 44AB has been introduced in the Income tax Act 1961 by the Finance Act 1984 This section provides for audit of accounts of assessees having total sales turnover or gross

Turnover Definition As Per Income Tax Act

Turnover Definition As Per Income Tax Act

https://taxguru.in/wp-content/uploads/2022/06/Rates-of-Depreciation-as-Per-Income-Tax-Act-1961.jpg

Depreciation Rate Chart Depreciation Chart As Per Income Tax Act

https://i.ytimg.com/vi/nDSXe-5ps_0/maxresdefault.jpg

Income Tax Act 1961 Establishing Taxation Rules In The Country

https://getlegalindia.com/wp-content/uploads/2021/09/income-tax-act-1.jpg

A taxpayer is required to have a tax audit carried out if the sales turnover or gross receipts of business exceed Rs 1 crore and in case of profession exceed Rs 50 lakhs in the 31 rowsThe deciding basis i e turnover is not defined in the Act thereby leading to different interpretations Added to that are the varied kinds of businesses and

What is Section 194Q of Income Tax Act The section 194Q relates to tax deducted at source TDS on purchase of goods Know section 194Q applicability TDS rate turnover limit with Turnover in simple terms is the total volume of business However the Turnover has been defined under the GST law It means total value of all taxable supplies and exempt supplies

More picture related to Turnover Definition As Per Income Tax Act

How To Calculate Depreciation Chart As Per Income Tax Rules How To

https://i.ytimg.com/vi/Y6lBKINruw4/maxresdefault.jpg

194R Of Income Tax Act 1961 YouTube

https://i.ytimg.com/vi/oU0Rsz3ZsnE/maxresdefault.jpg

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

As per Section 44AB of the Income Tax Act an assessee whose turnover from profits and gains from business or profession exceeds Rs 1 00 00 000 during the Financial What is the Definition of Turnover as per the Income Tax Act Now the term turnover sale etc is not defined in the Income Tax Act So let us refer some other sources

As per Section 43 5 of the Income Tax Act 1961 intra day trading shall be considered as speculation business transactions and the income therefrom would be either As per the income tax act 1961 section 44AB an assessee is required to get his accounts audited when his turnover sales from business is more than Rs 1 crore section 44AD

Section 143 2 Of Income Tax Act All You Need To Know

https://housing.com/news/wp-content/uploads/2023/01/Presumptive-tax-scheme-under-Section-44AD-of-the-Income-Tax-Act.jpg

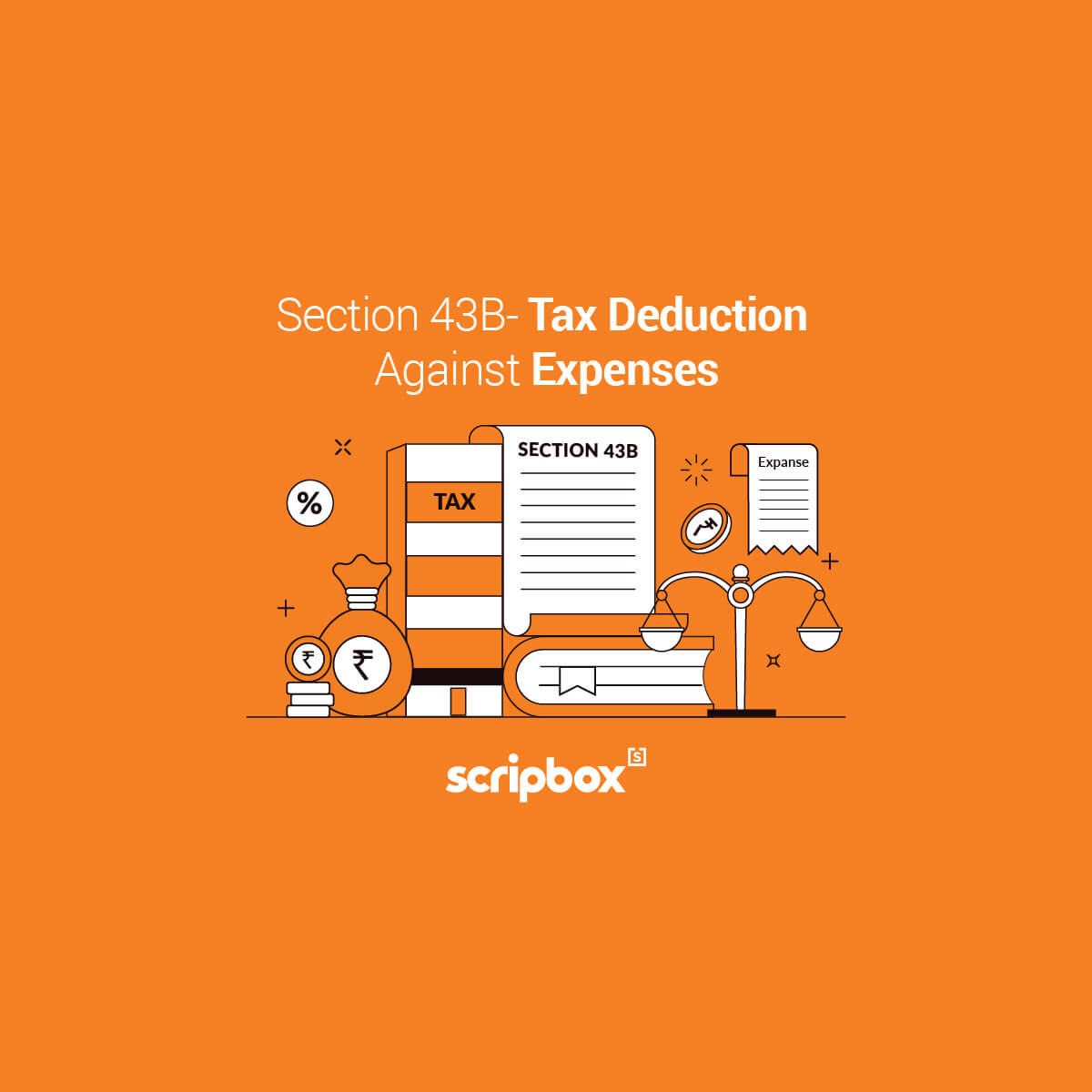

Section 43B Of Income Tax Act Tax Deduction On Actual Payment

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/09/section-43b-of-income-tax-act.jpg

https://www.taxmann.com/post/blog/faqs-how-to...

Learn how to calculate gross receipts and sales turnover for tax audits with our detailed FAQ guide Understand inclusions exclusions and specific scenarios for accurate tax

https://taxguru.in/income-tax/meaning-t…

Sec 145A is for determination of only income chargeable to tax but not for determination of tax rate thresholds etc However in the absence of any other definition of turnover gross receipts provided in the Act it leads

Income Tax Act POCKET Edition Finance Act 2023 By Taxmann s

Section 143 2 Of Income Tax Act All You Need To Know

How To Calculate Total Revenue In Economics The Tech Edvocate

Section 27 Of The Income Tax Act Sorting Tax

Know About Section 43B In Income Tax Act 1961

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Section 194M Of Income Tax Act 1961 Sorting Tax

Depreciation Chart As Per Income Tax

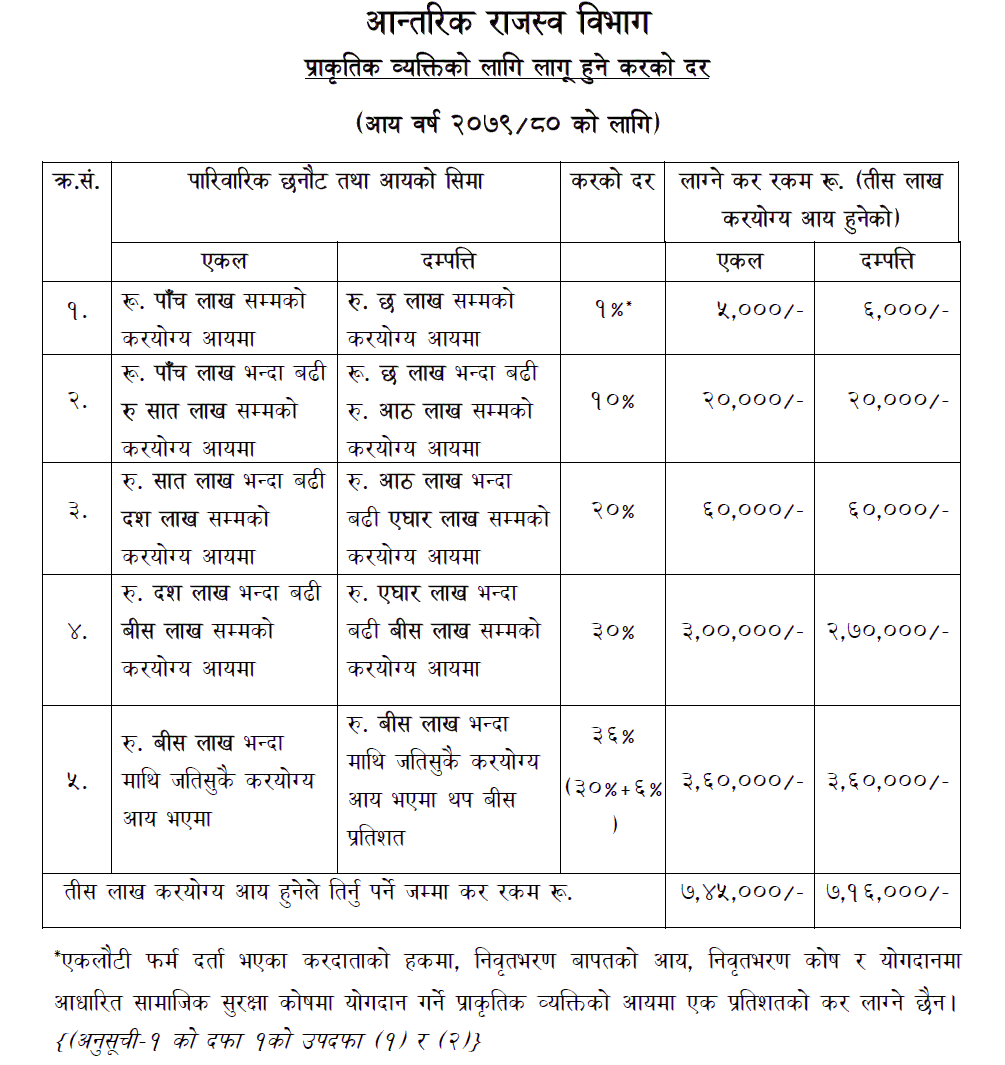

Income Tax Rate In Nepal For Fiscal Year 2079 80 For Natural Person

Turnover Definition As Per Income Tax Act - A taxpayer is required to have a tax audit carried out if the sales turnover or gross receipts of business exceed Rs 1 crore and in case of profession exceed Rs 50 lakhs in the