Roll Over Definition Financial Rollover risk is associated with refinancing debt and derivatives trading It refers to potential losses when re establishing a position as a prior one is closed or expires

It refers to the process of moving funds from one account to another The primary objective of a rollover is to allow individuals to transfer their assets between similar What is a Rollover A rollover involves the transfer of funds from one investment to another These transactions usually involve the transfer of funds between

Roll Over Definition Financial

Roll Over Definition Financial

https://www.sbj-sportland.de/images/product_images/popup_images/Ervy14.jpg

Ribina Gallery Roll Over

https://ribinarescue.com/images/gallery/0/41_Up6yCGBTfZ.png

Coming Soon Roll 20

https://roll20.co.uk/wp-content/uploads/2022/08/logo-square.png

An IRA rollover is a transfer of funds from a retirement account such as an employer sponsored plan into an individual retirement account IRA The purpose of a rollover is to maintain An equity rollover is a common component in private equity transactions that sees the seller reinvest a percentage of proceeds back into the acquired company

Rollover risk relates to the risks that are associated with refinancing debt It s usually faced by companies that have a debt obligation like a loan that is going to mature A rollover is the process of keeping a position open beyond its expiry The term is commonly used in forex where it is used to explain the possible interest that may be earned or incurred

More picture related to Roll Over Definition Financial

Going Against The Grain Financial Services Advisory

https://fsainvest.com/wp-content/uploads/2021/09/2021.09-MMU.jpg

Financial Quotes And Sayings

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064411490815

Over A Barrel

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100046138457842

A rollover lets you move funds from one retirement savings account into another without triggering unintended taxes or fees It can make sense to do a rollover if you re changing jobs if you want to consolidate accounts or if a A rollover is a valuable financial strategy that allows you to transfer assets between investment accounts while maintaining their tax advantaged status By understanding and utilizing this

An IRA rollover consolidates multiple retirement accounts from past jobs offering clearer management reduced fees and diverse investment options This flexibility is essential A rollover Individual Retirement Account IRA is an account that allows you to transfer assets from an old employer sponsored retirement account to a traditional IRA The

Date Un Roll

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063691833216

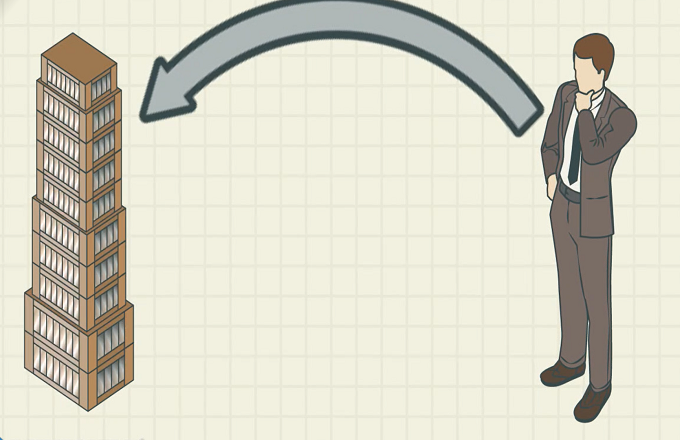

ROLL OVER Phrasal Verb ROLL OVER Definition Meaning And Example

https://tod-ogimages.vercel.app/roll over.png

https://www.investopedia.com › terms …

Rollover risk is associated with refinancing debt and derivatives trading It refers to potential losses when re establishing a position as a prior one is closed or expires

https://www.supermoney.com › encyclopedia › rollover

It refers to the process of moving funds from one account to another The primary objective of a rollover is to allow individuals to transfer their assets between similar

500 Casino On Twitter Should We Roll Over Or Under

Date Un Roll

Clip Art Library

Clipart Definition Connotation Picture 471143 Clipart Definition

M over Company

Roll Over Definition In Finance

Roll Over Definition In Finance

The Roll Up Experience Bangalore

Waller Tax And Financial Services Lancaster PA

Bankruptcy To Financial Freedom

Roll Over Definition Financial - A rollover is the process of keeping a position open beyond its expiry The term is commonly used in forex where it is used to explain the possible interest that may be earned or incurred